The 5-Minute Rule for Paul B Insurance

Wiki Article

Not known Details About Paul B Insurance

represents the terms under which the insurance claim will be paid. With house insurance coverage, for instance, you might have a substitute expense or real cash worth plan. The basis of how insurance claims are cleared up makes a large impact on just how much you make money. You ought to always ask just how cases are paid as well as what the cases process will be.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

They will certainly videotape your insurance claim and also consider it to learn what happened and just how you are covered. Once they choose you have a protected loss, they might send out a look for your loss to you or possibly to the fixing shop if you had a vehicle crash. The check will certainly be for your loss, minus your deductible.

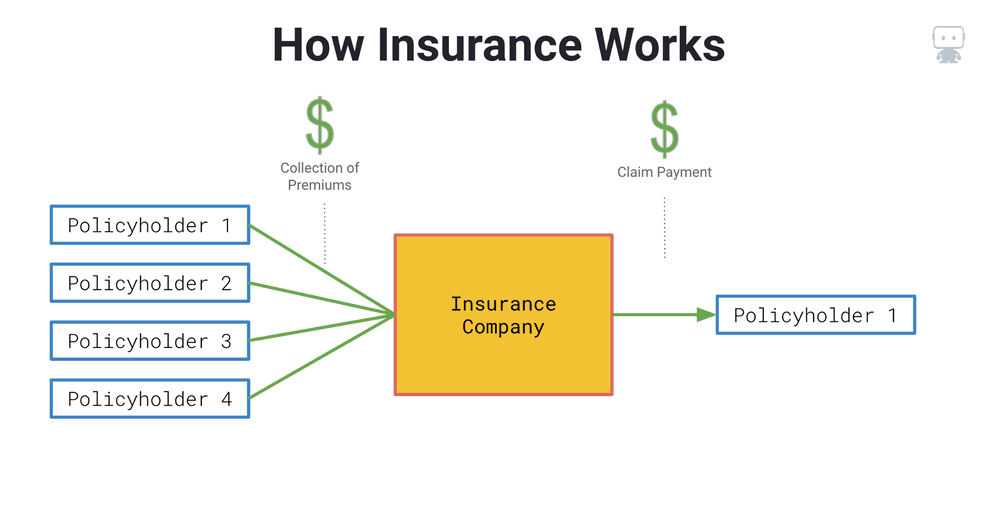

The thought is that the cash paid out in insurance claims with time will be much less than the total premiums gathered. You might seem like you're throwing money out the home window if you never file an insurance claim, yet having piece of mind that you're covered in the event that you do suffer a significant loss, can be worth its weight in gold.

Not known Facts About Paul B Insurance

Picture you pay $500 a year to guarantee your $200,000 home. This implies you've paid $5,000 for home insurance policy.

Because insurance policy is based upon spreading out the risk among lots of people, it is the pooled cash of all people paying for it that allows the company to build properties and also cover insurance claims when they occur. Insurance policy is a company. Although it would behave for the firms to simply leave rates at the exact same level constantly, the reality is that they need to make adequate cash to cover all the potential cases their policyholders might make.

Underwriting changes as well as price rises or declines are based on results the insurance policy business had in previous years. They market insurance coverage from just one business.

6 Simple Techniques For Paul B Insurance

The frontline people you handle when you acquire your insurance are the representatives as well as brokers who represent the insurance coverage firm. They will clarify the kind of products they have. The restricted agent is a representative of only one insurance firm. They an acquainted with that firm's items or offerings, but can not talk in the direction of various other firms' plans, rates, or product offerings.

Exactly how much danger or loss of cash can you think on your very own? Do you have the money to cover your costs or debts if you have an accident? Do you have special needs in your life that require extra coverage?

The insurance you need varies based upon where you are at in your life, what sort of possessions you have, as well as what your lengthy term objectives and also obligations are. That's why it is important to make the effort to discuss what you want out of your policy with your agent.

The Only Guide for Paul B Insurance

If you get a finance to purchase an automobile, and after that something happens to the car, space insurance coverage will certainly settle any section of your loan that basic vehicle insurance policy doesn't cover. Some lenders require their debtors to bring space insurance.

The primary function of life insurance coverage is to give money for your recipients when you pass away. Depending on the kind of policy you have, life insurance policy can cover: Natural fatalities.

Life insurance coverage covers the life of the guaranteed person. Term life insurance covers you for a period of time selected at acquisition, such as 10, 20 or 30 years.

The smart Trick of Paul B Insurance That Nobody is Talking About

Term life is popular due to the fact that it provides big payments at a reduced expense than irreversible life. There are some variations of typical term life insurance coverage plans.

Long-term life insurance policy plans construct cash money value as they age. pop over to this web-site A portion of the costs settlements is included to the cash money worth, which can earn interest. The look at this now cash worth of entire life insurance policy plans expands at a set price, while the Clicking Here cash money worth within universal policies can change. You can make use of the cash worth of your life insurance policy while you're still active.

If you contrast ordinary life insurance policy rates, you can see the distinction. As an example, $500,000 of whole life insurance coverage for a healthy and balanced 30-year-old lady costs around $4,015 each year, usually. That same degree of coverage with a 20-year term life plan would set you back approximately concerning $188 yearly, according to Quotacy, a broker agent firm.

Facts About Paul B Insurance Uncovered

Variable life is another long-term life insurance policy option. It's an alternate to whole life with a set payout.

Right here are some life insurance policy basics to help you better comprehend how insurance coverage functions. For term life plans, these cover the cost of your insurance policy and also management prices.

Report this wiki page